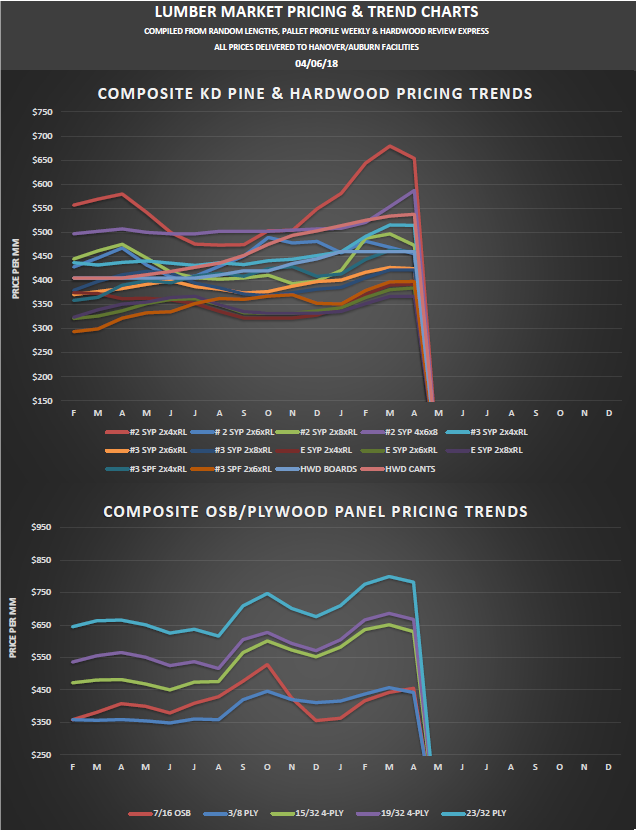

Over the past 5 months, our customers have seen increasing prices for pallets, boxes, and crates, often with little or no warning. There are a number of colliding factors, mostly attributable to rising lumber costs, increased competition for labor, and fewer over-the-road truckers to transport goods. While each adds to the lion’s share of the cost to produce wood packaging, the single biggest contributor to pricing instability is the volatile nature of the low-grade lumber market.

The wood packaging industry uses both hardwoods and softwoods in the manufacturing of sellable products. Raw materials account for anywhere from 50% to 65% of the costs of the goods sold, depending on what is being built. There are often upward swings in the hardwood markets, typically every few years. When they occur, they’re dramatic and often stay at the increased market value. When these swings occur, many in the pallet industry will shift to alternative sources, i.e. softwood. Softwood market shifts are usually a little more predictable, with price increases occurring in late winter through spring, and dropping in the summer months through early winter.

The low-grade lumber is the most economical alternative when building wood packaging products. In other words, the sawmill produces lumber for higher-grade customers, at a much higher price. Our industry buys the off fall or low-grade lumber, which is typically the center of the log. The sawmill doesn’t make much money on the low-grade material, but it’s essential to the overall mix of the log that they recoup the costs in processing logs. The competition for the low-grade materials can be fierce, including environmental mats, railroad ties, and flooring, to name a few. They can typically pay more for the low-grade material, which drives our costs up as an industry. In a typical “hard” market, the wood packaging provider will raise and lower prices based on these market swings, with 30-day written notices to customers.

Now that historical “normal” market conditions have been addressed, let’s dive into the current market. The biggest difference this year is the economy. Business is good and demand is high. Unfortunately, one of the key sources of supply, low-grade hardwood, just isn’t there for us anymore. There are fewer hardwood mills today than there were 20 years ago, and the competition for the remaining low-grade is fierce, with competing industries able to pay more for the supply. When there is supply available, the mills can’t get trucks underneath the product to deliver. Turning our attention to the softwood, the ability to economically procure Spruce-Pine-Fir (SPF) at low prices is not a reality due to the ongoing trade dispute between Canada and the United States. All this leaves pressure on the Southern-Yellow-Pine (SYP) market, with all of us fighting for the available supply, including a larger than normal amount being exported to China. Summing it up, the economy is great, demand is high, supply is tight, prices are going up, we’re all raising our prices to our customers, with little or no warning, but we can’t get the product to supply our customers due to transportation issues.

In conclusion, the lumber costs we’re using today in pricing finished goods won’t hold up tomorrow as the market is shifting upward by the day. We’re operating in a low margin industry, so any significant upward demand requires pricing to be adjusted immediately. Hardwood cants have seen increases of 35% since this same time last year. The ability to predict pricing levels 30 days from now just isn’t possible. Unfortunately, no one knows when prices will stabilize, much less come down. The best we can do is keep the lines of communication open, be as proactive as possible in pricing, and hope a more normal market returns sometime soon.